iPhone / iPad Android

When can I retire? Will my retirement portfolio outlast me? Is my nest egg (or projected nest egg) enough to retire upon? How much money will I leave to my heirs? How much do I need to reach financial independence? No-one can ever know for sure, but if you model the future based on the past you can have a pretty good idea of what is LIKELY to happen.

There are a great many calculators where you can select a reasonable rate of inflation and reasonable return, but no portfolio is likely to generate a static rate over time. Volatility is the killer! Suffering through a drop in the stock market at the wrong time can make a tremendous difference in your overall outcome. Only after you understand the past can you confidently plan for the future.

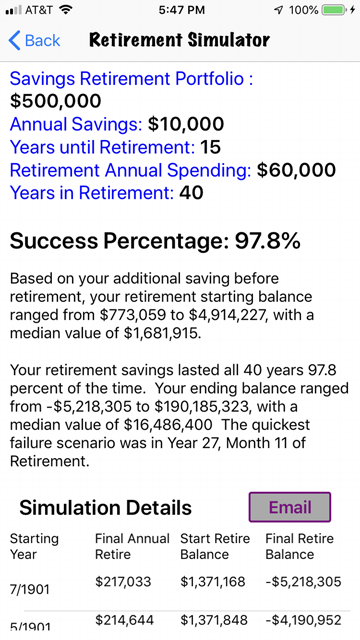

The Retirement Investing Calculator Simulator uses actual data from every year and month from 1871 through 2018 to find out. It takes the actual United States stock market return, U.S. bond market return, and inflation numbers from each month to simulate thousands of historically-accurate retirement scenarios.

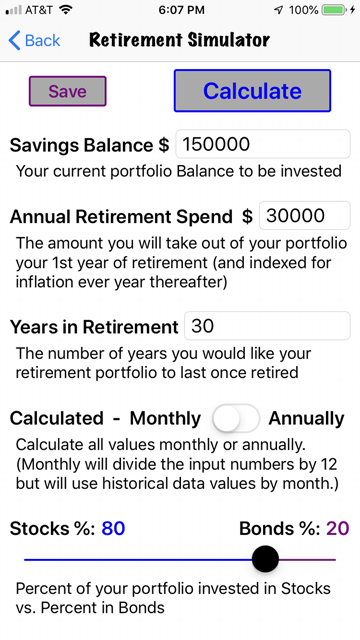

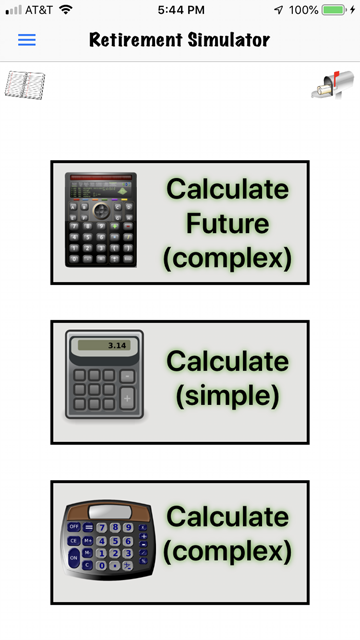

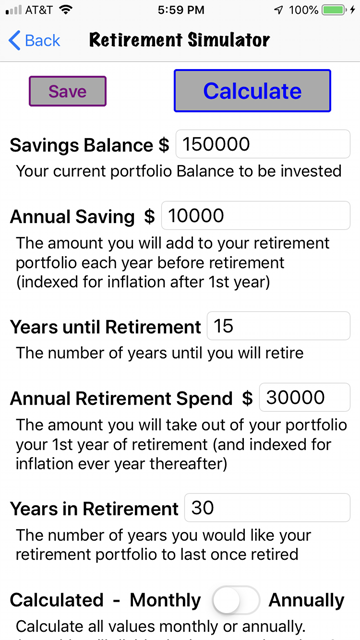

When you enter your retirement portfolio amount, annual spending, and years in retirement, the simulator will calculate your personalized results, running up to several million calculations to determine how you would’ve fared (and are likely to fare in the future.). You can further personalize your results by changing the stock/ bond mix, fund fees, calculation term, amount saved each year, and years until retirement using Advanced mode. It also gives you the option to randomize all the months of history to plan for an even wider range of scenarios.

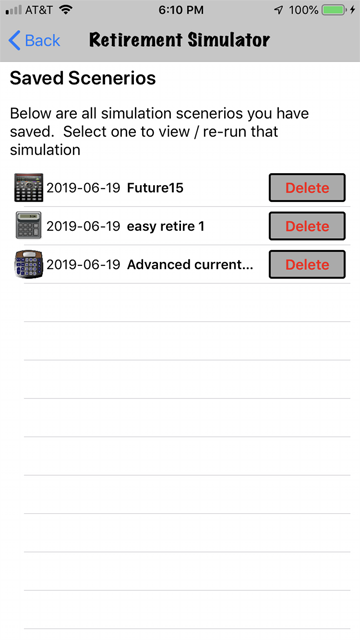

The Retirement Investing Calculation Simulator gives you the choice to save or email your results, so you can come back and try different choices.

The Retirement Investing Calculator Simulator is a Monte-Carlo style simulator which uses historical numbers to determine the likelihood of success vs failure. You can customize it per your preferences. It uses data from the S&P 500, the 10 Year Treasury Bond, and the Consumer Price Index. It also uses the rough precursors to those metrics to approximate them during years before they existed.

Disclaimer: The information and calculations in this application are for educational purposes only, and do not constitute financial advice. Contact a licensed financial planner for specific retirement advice and for making retirement financial decisions. All data points included are correct to the best of our knowledge, but no warranty is made regarding the accuracy or applicability of this data or calculations. The owners / authors of this application (including Workman Consulting LLC) hereby disclaim all responsibility for any use / misuse of this application and the data provided by this application. The authors of this app do not give any warranty as to the accuracy, reliability or completeness of information; and do not accept any liability for any error or omission on this app or for any resulting loss or damage suffered by the recipient or any other person. By downloading and/or using the application, you agree to these terms.

Past returns are not indicative of future performance. Even if an investing strategy would’ve survived 100% of past scenarios, it does not guarantee that it will do so in the future.